Thinking About Renting Out An Alpharetta Property? Here’s What the Market Tells Us

The Alpharetta housing market has changed a lot over the past decade, and if you own property here or you’re considering buying one as a rental, understanding where the market has been and where it’s heading can help you make smarter long-term decisions.

The Alpharetta housing market has changed a lot over the past decade, and if you own property here or you’re considering buying one as a rental, understanding where the market has been and where it’s heading can help you make smarter long-term decisions.

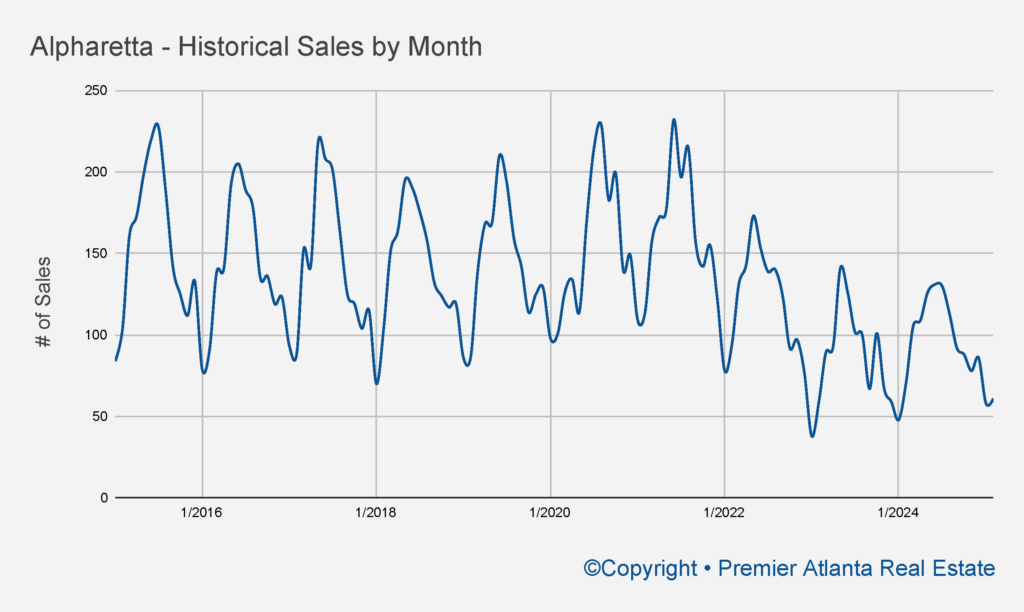

I’ve been tracking Alpharetta’s monthly single-family home stats since 2015, and the patterns we’ve seen offer some valuable insight for current and future landlords.

Rental Activity Reflects Sales Volume Trends

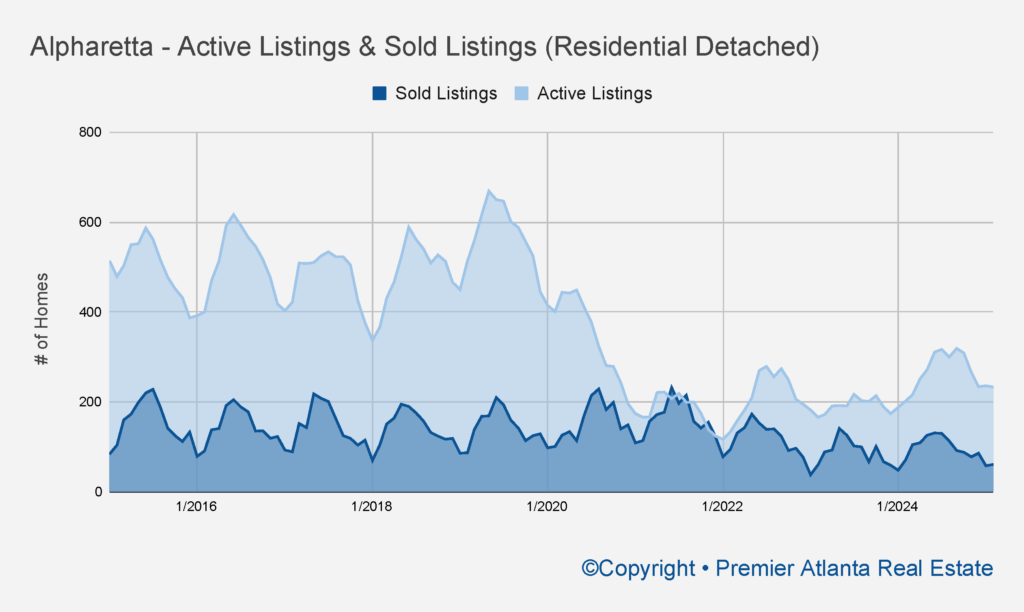

Between 2015 and early 2020, Alpharetta typically saw between 80 to 200 single-family home sales per month, following fairly predictable seasonal trends. When the post-pandemic market kicked into high gear, that number spiked, peaking at 173 sales in May 2022.

Sales Have Slowed

Since then, activity has tapered off, suggesting the market is finding its balance again. That’s good news for rental owners because it points to stabilizing property values and less frenzied buyer competition. In short, if you’re holding property or thinking about picking one up, it looks like a more measured real estate market and not a volatile or declining one.

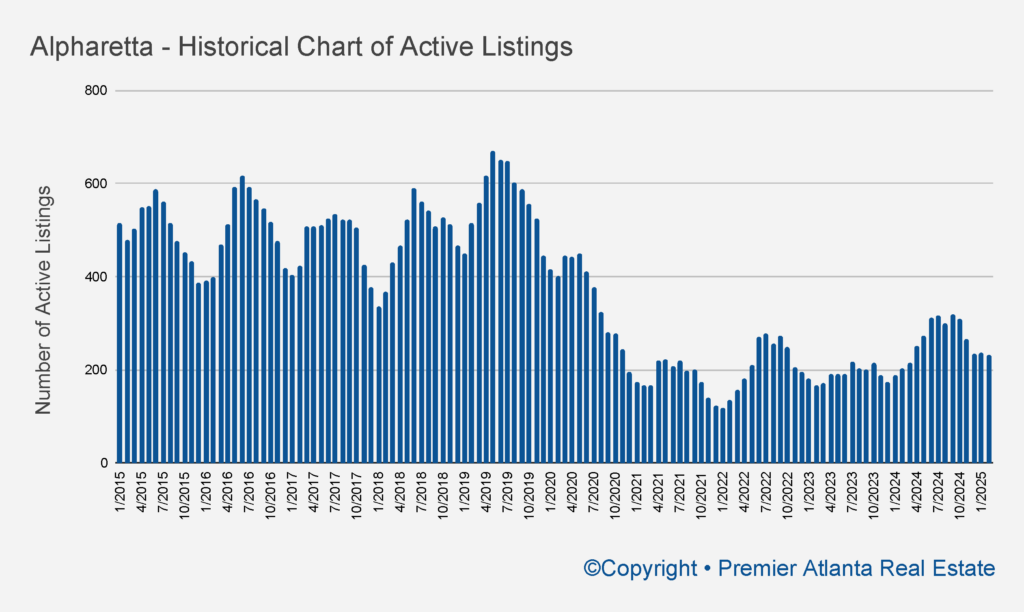

Inventory and Demand – What It Means for Rentals

A deep look at inventory levels confirms the trend. Back in 2015–2019, Alpharetta would regularly have around 600 homes on the market. Recently, that number has dropped substantially, and while we’re starting to see a slow uptick, supply is still well below what we’d call balanced from a historical perspective.

Still Low Historically

For investors, that’s encouraging. It suggests there’s continued demand for homes in Alpharetta, not just for buyers but for renters too. Even with higher rates, the limited supply is keeping pressure on the rental market. Well-maintained homes in desirable neighborhoods aren’t sitting vacant for long.

Seller vs. Buyer and What That Tells You as a Landlord

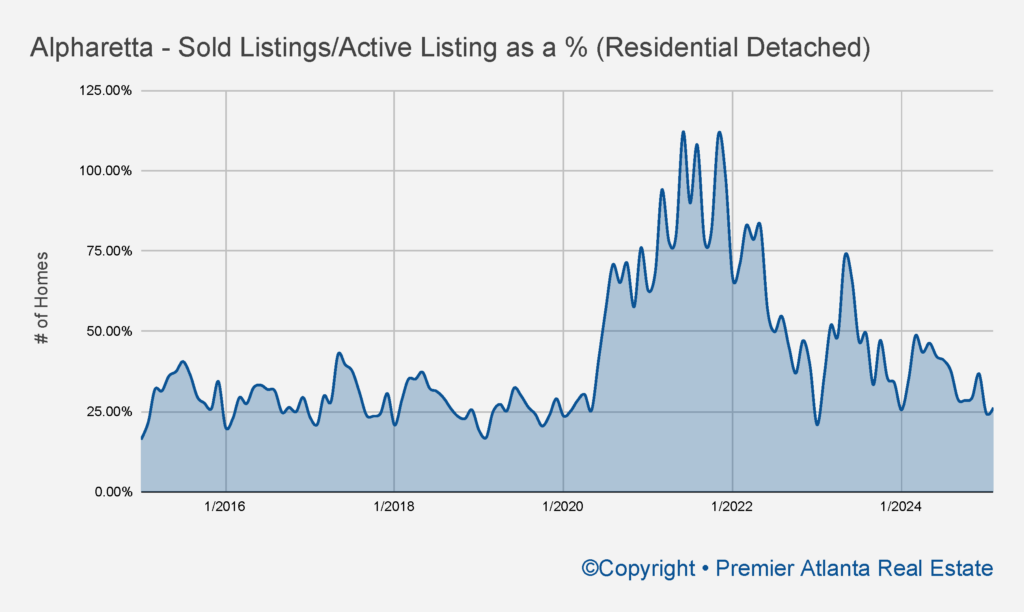

One of the indicators I watch closely is the sold-to-active ratio. When that number climbs, it usually means sellers have the upper hand. When it dips, buyers get some leverage. In 2021, sellers dominated—with over 60% of active homes getting sold in a given month and, in some cases, over 100% due to carryover inventory.

More Normal Ratios

By early 2025, we’re sitting closer to 30%, which feels more neutral. From a rental perspective, that balance is helpful. It tells you that while the red-hot bidding wars have cooled, demand hasn’t disappeared. A neutral market still supports steady appreciation and keeps long-term rental investments viable.

Property Values – A Steady Climb with Some Bumps

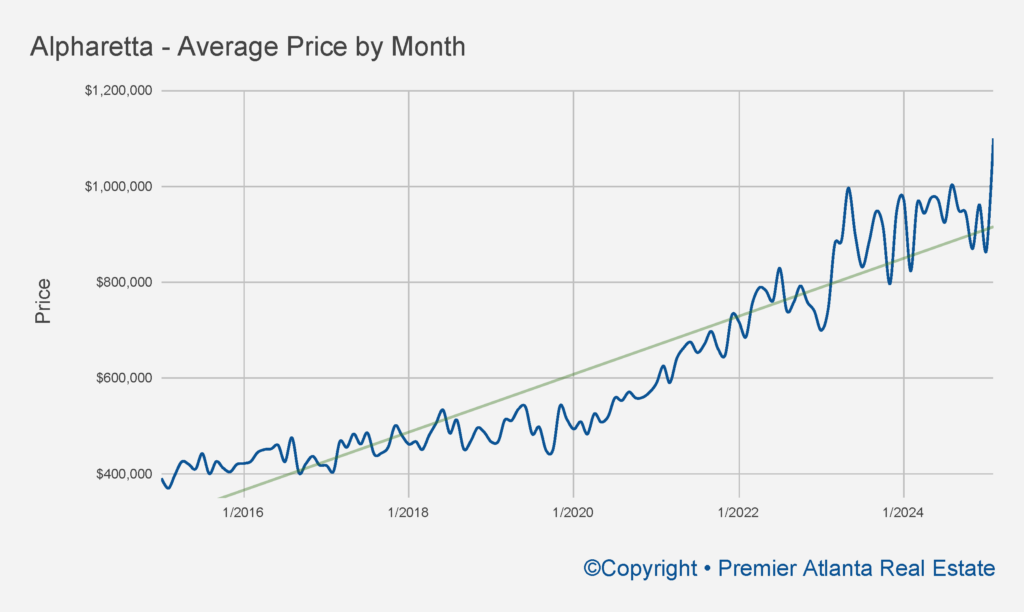

Since 2015, average Alpharetta home prices have climbed from below $400,000 to north of $900,000 by 2024. Yes, we saw a few blips along the way—2023 in particular, brought slight pullbacks as rates jumped – but the general trajectory is strong.

Leveling But Still Above Trendline

This matters for two big reasons if you’re a landlord:

- Your asset continues to appreciate, building long-term equity even while it generates monthly income.

- Rents tend to follow home values, especially in areas with limited inventory. As ownership costs rise, so does the ceiling for competitive rent pricing.

What List-to-Sale Price Ratios Say About Market Resilience

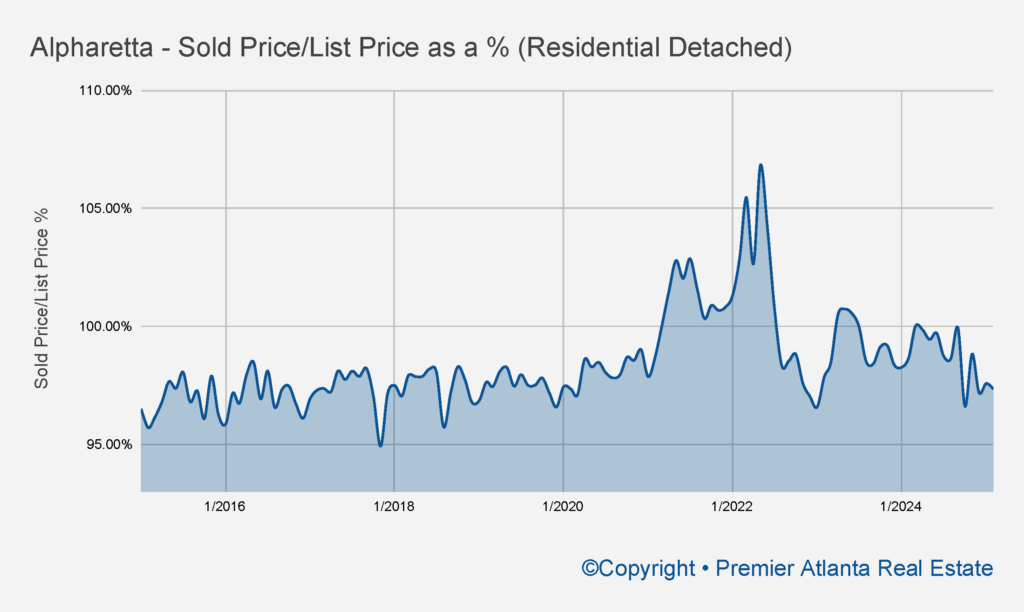

At the peak, homes were selling for 100% of the list price or more, and about half of all sales were closing above asking. That’s cooled down to about 97% recently, but even now, 36% of homes in Alpharetta are still closing over the list price.

Still Stronger Than Metro Atlanta

That kind of performance signals a resilient market. For landlords, it underscores the value of keeping your property in great condition. Homes that show well are still commanding top dollar even if it’s rent instead of sale.

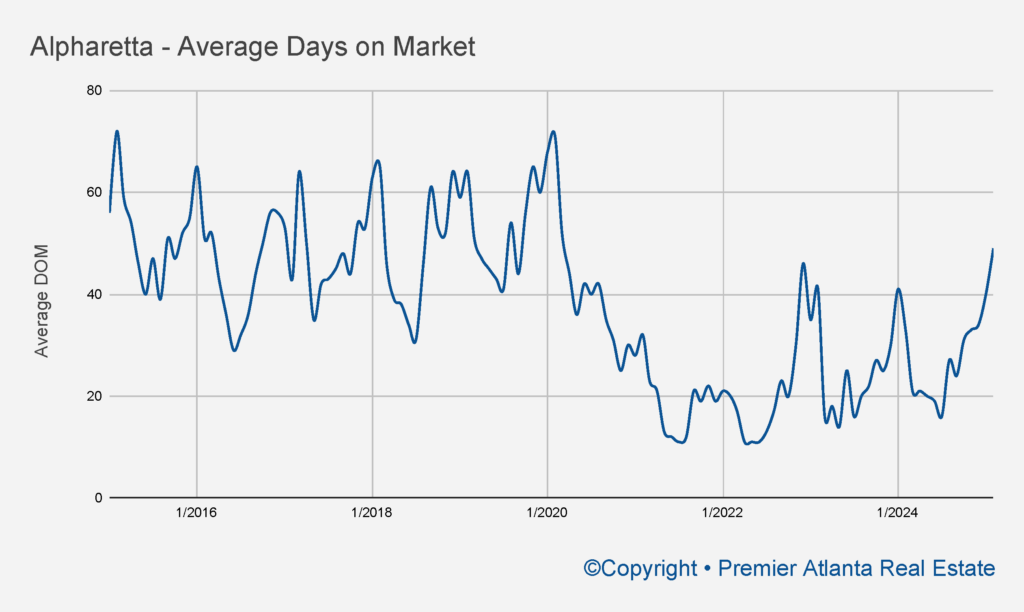

Days on Market – Still Favorable for Landlords

In 2021, homes were flying off the market, many in just a few days. By 2025, that number has stretched to 40–50 days. That’s not a red flag. It’s closer to what we used to call “normal”.

Still Within A Safe Range

If you’re thinking about leasing your home, this means rental turnover might take a little longer than it did at the peak, but good properties are still moving. And longer days on market for home sales can sometimes push would-be sellers toward renting instead.

Should You Rent It Out Instead of Selling?

Here’s where the current numbers might work in your favor:

- Alpharetta prices have likely plateaued or are rising modestly but not skyrocketing like they did in 2021. If you don’t need to sell, you could hold onto your home and benefit from both rental income and long-term appreciation.

- Interest rates are keeping many buyers on the sidelines, which means strong rental demand is likely to stick around. In fact, some would-be buyers are turning into long-term renters, which creates a more stable tenant base.

- Even in a neutral market, Alpharetta continues to outperform many other Metro Atlanta areas due to strong schools, a walkable downtown, tech sector job growth, and limited housing stock.

A Quick Word on Risk

Of course, not every rental is going to perform the same. Homes that are outdated or priced too aggressively whether for sale or for rent, are sitting longer and getting less favorable terms.

We’ve seen time and again that updated, well-priced homes get rented quickly and tend to attract higher-quality tenants who stay longer. If your home needs some work, it might be worth investing in a few improvements before putting it on the rental market.

What’s Ahead?

Unless something dramatic changes, I expect Alpharetta to stay steady through the rest of 2025. The key factors of low inventory, strong local economy, and buyer fatigue from high rates should keep rental demand strong.

If you’re sitting on a property in Alpharetta and wondering what to do with it, it may be time to consider the long-term benefits of keeping it as a rental. And if you’re thinking about buying an investment property, the current market might offer just enough breathing room to make a strategic purchase.